Detailed Zakat Information

Donate NowReal Estate Investments in Property Owning Companies

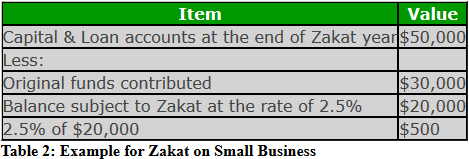

Real Estate investments (not house under personal use) are also required to be included in Nisab when calculating Zakat. In case your real estate is on rent, Zakat applies on rental income only. In case of real estate business (as merchandise), Zakat will be calculated on the actual property value. Suppose there are loan accounts held by the members of a company or corporation whose main asset is an immovable property which produces income in the form of rentals. Such loan accounts represent moneys owed to the members thereof. The original funds (whether in the form of share capital or loan account) contributed to the company, which in substance are represented by the fixed property concerned, should not be taken into account and should be deducted from the amount of the loan account standing to the credit of the member at the end of the Zakat year concerned. The difference, which is attributable to profits or subsequent cash injections, is subject to Zakat each year and is treated as cash for Zakat purposes.

To read more about detailed information on Zakat, click here…