Detailed Zakat Information

Donate NowPrivate Companies, Corporations and Partnerships

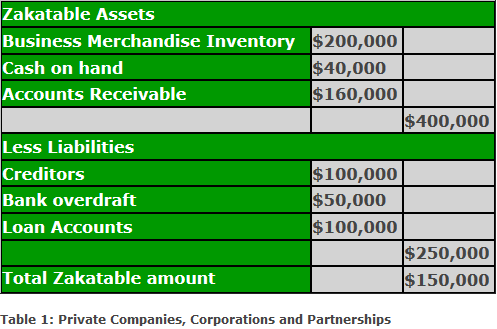

a) The shareholders in a company must pay Zakat on the Zakat-able assets less allowable liabilities in proportion to their shareholding. ABC Corporation has 5 shareholders, L, M, N, O, and P who own the issued shares in the company in equal proportions. Company A carries on business as a manufacturer of garments. Each shareholder will be liable to pay Zakat on one fifth of the Zakatable assets of the company less the liabilities incurred in respect of those assets at the end of the relevant Zakat year. The Zakatable position of Company A at the end of the relevant Zakat year is for example as follows:

L will pay 2.5% of $30,000 = $750

M will pay 2.5% of $30,000 = $750

N will pay 2.5% of $30,000 = $750

O will pay 2.5% of $30,000 = $750

P will pay 2.5% of $30 000 = $750

b) Similarly, the Zakat liability of the members of a corporation will be calculated in proportion to the respective member’s share in the corporation.

c) The Zakat liability of partners will also be calculated in accordance with their profit sharing ratio.

To read more about detailed information on Zakat, click here…