Detailed Zakat Information

Donate NowHow should I Calculate Zakat?

The amount of wealth which makes one liable for Zakat is called Nisab. The payment of Zakat is compulsory on the excess wealth which is equal to or exceeds the value of Nisab, and which is possessed for a full Islamic year. If such wealth decreases during the course of the year, and it increases again to the value of Nisab before the end of the year, the Zakat then must be calculated on the full amount that is possessed at the end of the year.

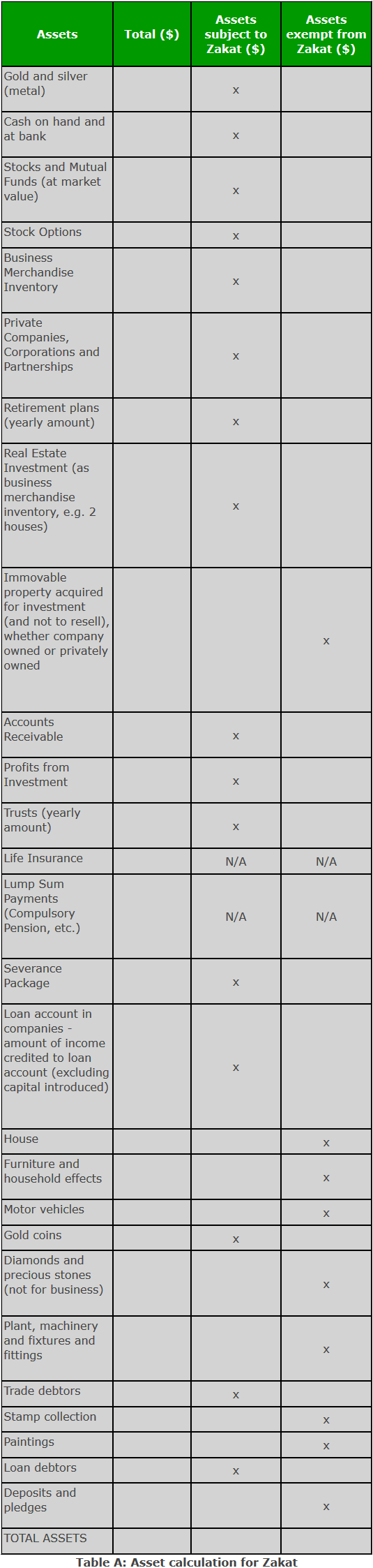

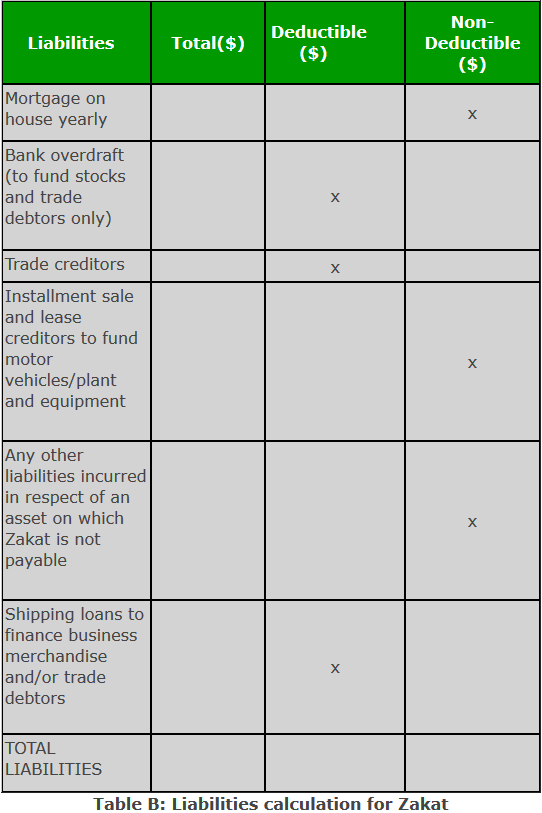

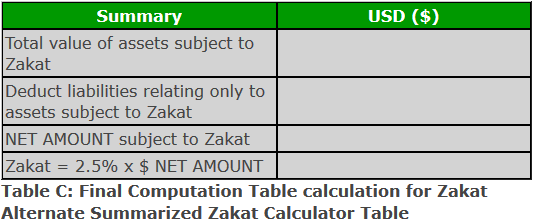

Simple Zakat Calculator Table

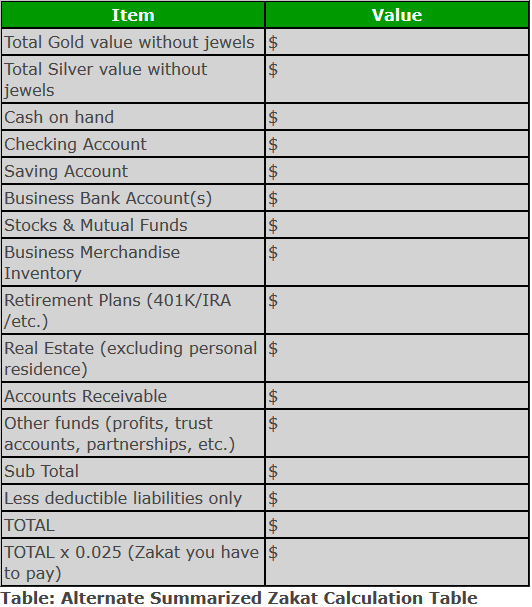

Following is a simple table which may help in calculating Zakat:

For a simpler calculation, kindly use this table. All these assets are Zakat-able, and the liabilities should include only those which are deductible (i.e. liabilities incurred due to assets that are Zakat-able, not on assets that are not Zakat-able). For example, the house you live in is non-Zakat-able so any mortgage payment on it is not deductible.

To read more about detailed information on Zakat, click here…